Cash Flow Statement Pdf

CASH IS KING;is a known fact, that it is the basis of any business. No bills, employees or for that not even you would be paid without cash. Expansions or addition to businesses happen only through cash. In financial terms, cash flow statement is a statement (report) of flows (both in and out of the. Statement of Cash Flows Example. Below is an example from Amazon’s 2017 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. Learn how to analyze Amazon’s consolidated statement of cash flows in CFI’s Amazon Advanced Financial Modeling Course. Source: amazon.com. Chapter 6 – Statement of Cash Flows The Statement of Cash Flows describes the cash inflows and outflows for the firm based upon three categories of activities. Operating Activities: Generally include transactions in the “normal” operations of the firm. Investing Activities: Cash flows resulting from purchases.

The statement of cash flows provides valuable information about a company's gross payments and receipts and allows insights into its future income needs. The cash flows statement is comprised of three sections: operating activities, investing activities, and financing activities.

There are two methods for preparing a statement of cash flows: the direct method preferred by the Financial Accounting Standards Board (FASB) and the indirect method preferred by most businesses for its simplicity. The difference between the two methods lies in the operating activities section of the statement. XYZ Company Statement of Cash Flows1. Net Income$ 110,5002. Inc in Accts Rec(30,000)4. Inc in Inventory(20,000)5. Dec in Prepaid Exp10,0006.

Inc in Accts Payable35,0007. Dec in Accruals(5,000)8. Net Cash Flows from operating activities$150,5009. Inc in Investments(30,00010. Inc in Plant & Equipment(100,000)11. Net Cash Flows from investing activities(130,000)12. Inc in LT Bank Loans50,00013.

Dividends Paid(65,000)14. Net Cash Flows from financing activities(15,000)15. Net increase in cash flows$5,500. Looking at the, accounts receivable (line 3) has increased by $30,000 from $170,000 to $200,000. Since that increase occurred on the asset side of the balance sheet, it is shown as a negative figure. If the firm extended $30,000 more in credit to its customers, then it had $30,000 less to use. Likewise, inventory (line 4) increased by $20,000.

Prepaid expenses (line 5) decreased by $10,000. Terjemah kitab tafsir jalalain pdf. A decrease in an, a source of funds to the firm, is a positive number. Cash increased by $35,000, but it is not included in our initial analysis.

CASH IS KING;is a known fact, that it is the basis of any business. No bills, employees or for that not even you would be paid without cash. Expansions or addition to businesses happen only through cash. In financial terms, cash flow statement is a statement (report) of flows (both in and out of the business) cash. What is Cash Flow Statement?A cash flow statement provides information about the changes in cash and cash equivalents of a business by classifying cash flows into operating, investing and financing activities. It is a key report to be prepared for each accounting period for which financial statements are presented by an enterprise.Monitoring the cash situation of any business is the key. The income statement would reflect the profits but does not give any indication of the cash components.

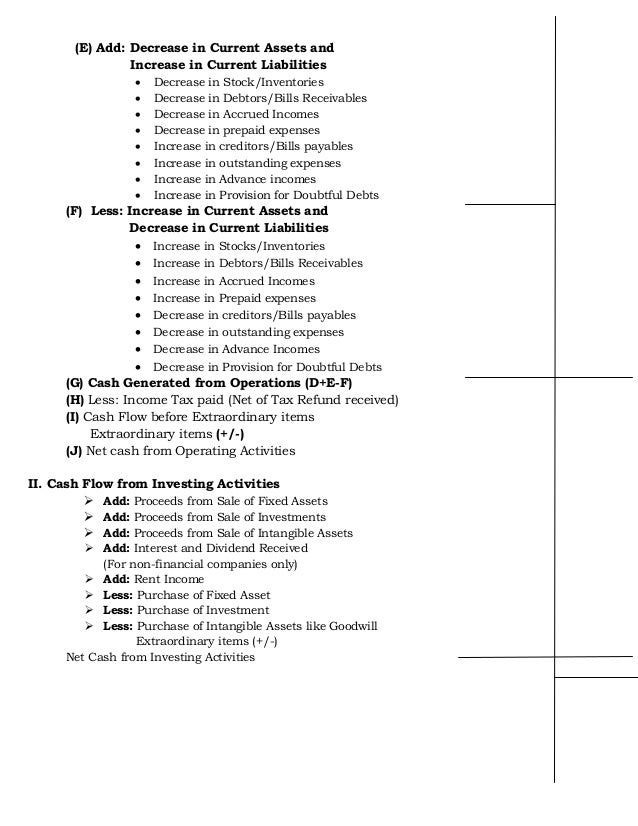

The important information of what the business has been doing with the cash is provided by the cash flow statement. Like the other financial statements, the cash flow statement is also usually drawn up annually, but can be drawn up more often. It is noteworthy that cash flow statement covers the flows of cash over a period of time (unlike the balance sheet that provides a snapshot of the business at a particular date). Also, the can be drawn up in a budget form and later compared to actual figures. Cash Flow Statement (Main heads only)(A) Cash flows from operating activities xxx(B) Cash flows from investing activities xxx(C) Cash flows from financing activities xxxNet increase (decrease) in cash and cash xxx equivalents (A + B + C) + Cash and cash equivalents at the beginning xxx = Cash and cash equivalents at the end xxxx Methods of preparing the Cash Flow StatementsOperating activities are the main source of revenues and expenditures, thereby cash flow from the same needs to be ascertained.

The cash flow can be reported through two ways:Direct method that discloses the major classes of gross cash receipts and cash payments andIndirect method that has the net profit or loss adjusted for effects of (1) transactions of a non-cash nature, (2) any deferrals or accruals of past/future operating cash receipts and (3) items of income or expenses associated with investing or financing cash flows. DIRECT METHOD:In the direct method, the major heads of cash inflows and outflows (such as cash received from trade receivables, employee benefits, expenses paid, etc.) are to be considered.As the different line items are recorded on accrual basis in statement of profit and loss, certain adjustments are to be made to convert them into cash basis such as the following:1. Cash receipts from customers = Revenue from operations + Trade receivables in the beginning – Trade receivables in the end.2. Cash payments to suppliers = Purchases + Trade Payables in the beginning – Trade Payables in the end.3. Purchases = Cost of Revenue from Operations – Opening Inventory + Closing Inventory.4. Cash expenses = Expenses on accrual basis + Prepaid expenses in the beginning and Outstanding expenses in the end – Prepaid expenses in the end and Outstanding expenses in the beginning. INDIRECT METHOD:of ascertaining cash flow from operating activities begins with the amount of net profit/loss.

This is so because statement of profit and loss incorporates the effects of all operating activities of an enterprise. However, Statement of Profit and Loss is prepared on accrual basis (and not on cash basis).

How To Prepare A Cash Flow Statement Pdf

Moreover, it also includes certain non-operating items such as interest paid, profit/loss on sale of fixed assets, etc.) and non-cash items (such as depreciation, goodwill to be written-off, etc. DisclaimerGARP does not endorse, promote, review or warrant the accuracy of the products or services offered by EduPristine, nor does it endorse the scores claimed by the Exam Prep Provider. Further, GARP is not responsible for any fees paid by the user to EduPristine nor is GARP responsible for any remuneration to any person or entity providing services to EduPristine. ERP®, FRM®, GARP® and Global Association of Risk Professionals™ are trademarks owned by the Global Association of Risk Professionals, Inc.CFA Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by EduPristine. CFA Institute, CFA®, and Chartered Financial Analyst® are trademarks owned by CFA Institute.We try our best to ensure that our content is plagiarism free and does not violate any copyright law. However, if you feel that there is a copyright violation of any kind in our content then you can send an email to care@edupristine.com.2019 © EduPristine. All rights reserved.

Cash Flow Document

DisclaimerGARP does not endorse, promote, review or warrant the accuracy of the products or services offered by EduPristine of GARP Exam related information, nor does it endorse any pass rates that may be claimed by the Exam Prep Provider. Further, GARP is not responsible for any fees or costs paid by the user to EduPristine nor is GARP responsible for any fees or costs of any person or entity providing any services to EduPristine.

Cash Flow Statement Template

ERP®, FRM®, GARP® and Global Association of Risk Professionals™ are trademarks owned by the Global Association of Risk Professionals, Inc.CFA® Institute does not endorse, promote, or warrant the accuracy or quality of the products or services offered by EduPristine.CFA® Institute, CFA®, CFA® Institute Investment Foundations™ and Chartered Financial Analyst® are trademarks owned by CFA® Institute. Utmost care has been taken to ensure that there is no copyright violation or infringement in any of our content.Still, in case you feel that there is any copyright violation of any kind please send a mail to abuse@edupristine.com and we will rectify it.2019 © EduPristine. ALL Rights Reserved.